21/11/2023 – China Toy and Juvenile Products Industry Report

Toys and juvenile products from China

At the 13th CTJPA conference, hosted on 30 March 2023 by the China Toy and Juvenile Products Association (CTJPA), the 2023 China Toy and Juvenile Products Industry Report was presented.

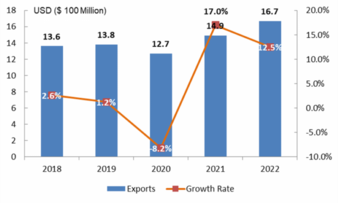

According to the data in the report, Chinese toy exports continued to grow in 2022 although the growth rate has slowed down. Exports of Chinese prams and buggies achieved two-figure growth over the previous year, while exports of toys and prams/buggies to the RCEP countries showed dynamic movement. In the domestic market, retail turnover of toys in 2022 increased slightly overall compared with the previous year. Retail sales of baby bottles and prams/buggies remained stable. Thanks to a favourable political environment, retail sales of car seats grew rapidly in 2021 but fell back in 2022 compared with the previous year. In 2022, exports of Chinese toys (excluding games) reached $48.36 bn, representing an increase of 5.6% over the previous year. Japan rose from third to second place in the list of top ten export markets, recording a 33.8% increase in imports. Exports of Chines toys (excluding games) to RCEP countries rose to $11.81 bn, 36.1% more than in the previous year. Total exports for 2022 of Chinese prams and buggies were valued at $1.67 bn, representing growth of 12.5%. The most marked increase, by over 37%, was in exports to RCEP member states, followed by the USA at 12%.

Domestic market

Total retail turnover of toys on the Chinese domestic market was RMB 88.31 bn, an increase of 3.3% over the previous year. Total retail sales of baby bottles amounted to RMB 6.65 bn (+1.1%) and total retail sales of prams/buggies added 1.9% to reach RMB 14.78 bn.

On the basis of sales data for the most important product categories on ‘Tmall’, the biggest online platform in China, soft toys showed the strongest growth in turnover, average price and concentration of top five brands compared with the previous year. In action figures, too, concentration of top five brands increased substantially. In the toy market, growth in sales of soft toys was the strongest, at 15.6%. Among juvenile items, the figure was strongest for children’s bicycles, with growth of 44.3%.